What is Cryptocurrency Trading and How Does it Work?

Posts by Colin TanMarch 12, 2024

Cryptocurrency trading is speculating on cryptocurrency price through a trading account or selling and buying cryptocurrency coins through an exchange. CFDs are trading derivatives, which allow you to predict cryptocurrency prices in the future, without having to take ownership of any underlying coins.

You can buy or ‘go long’ if you think that a specific cryptocurrency is going to increase in value, or you can sell or ‘go short’ if you think that it’s going to decrease in value.

The good thing is that you only need to invest a small amount of cryptocurrency to be given full exposure to the market. Of course, how much you gain or how much you lose is still calculated in relation to how much you’ve invested, but for someone who doesn’t have a lot of experience trading currencies in general, this is a great place to start.

There is one thing to know about cryptocurrency trading, and that is that it can be a steep learning curve because of the technology involved. You also need to learn how to read the data.

There are a lot of exchanges that include limits regarding investing in cryptocurrencies, and some accounts can end up being very expensive to maintain.

How Does the Cryptocurrency Market Work?

The thing about cryptocurrency markets is that they are decentralized, which means that they are not controlled by a central authority, like a government. Instead, they are operated, managed, and run across a network of computers. Cryptocurrencies can be sold and bought through exchanges and stored in virtual wallets.

When compared to conventional currencies, cryptocurrencies exist only digitally, and they are stored on a blockchain. When someone wants to send cryptocurrency to someone else, then they will send it to that user’s digital wallet.

However, the transaction isn’t considered complete until it has been verified and added to the blockchain through a method that is called mining. This is also how new cryptocurrency tokens are typically created.

What is Blockchain?

A blockchain is a digital ledger of recorded data. When it comes to cryptocurrencies, this is the transaction history of every token of cryptocurrency, and it shows how the ownership of the currency has changed over time. Blockchain records transactions in blocks, and new blocks are added to the front of the chain.

Blockchain technology comes with security features that typical computer files don’t usually have.

Network Consensus

A blockchain file is usually stored on multiple devices across the network, as opposed to in a single location. Generally speaking, they are readable by everyone within that network.

This makes the entire process incredibly transparent, and difficult to manipulate in any way. It is not vulnerable to human error, software malfunctions, or hacks.

Cryptography

Blocks and the blockchain connect together by cryptography. This is a combination of computer science and complex mathematics. Any attempt to adjust data is going to disrupt the links between the blocks, and therefore can be easily identified as fraud.

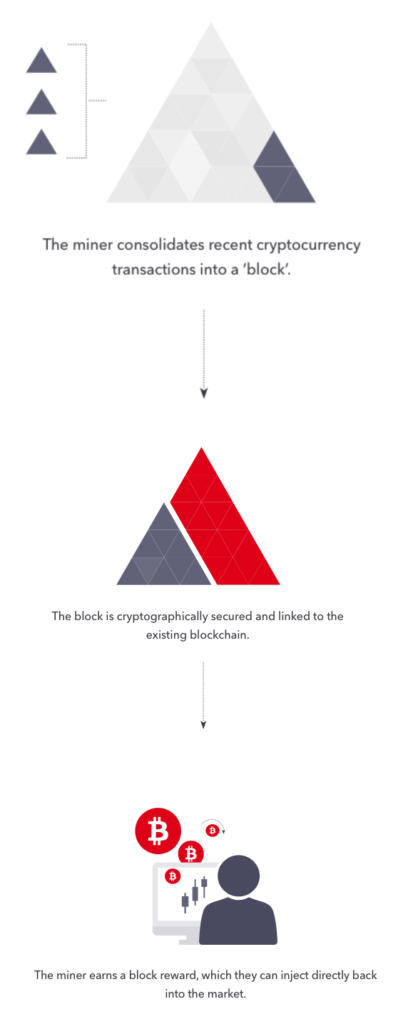

What is Cryptocurrency Mining?

Cryptocurrency mining is the process through which recent transactions of cryptocurrency are checked and verified and then added to the blockchain in the form of blocks.

Computers that are specifically designed to mine cryptocurrency will choose a pending transaction from a random pool, and make sure that the sender has enough funds to complete the transaction. It will check the transaction details against the transaction history that has been stored in the blockchain. Another check will confirm that the sender has authorized this transfer through their private key.

When a mining computer has validated a transaction, they will add it to a new block, and they will generate a cryptographic link between this new block and the previous block by finding a solution to a complicated algorithm.

When the computer has succeeded in connecting the two, the block will be added to the end of the blockchain, and the update to the blockchain will be shared with other users in the network.

What Moves Cryptocurrency Markets?

Cryptocurrency markets fluctuate according to supply and demand. However, because they are decentralized, they don’t really get affected by political and economic concerns that usually affect traditional stock markets. Of course, there is still a lot of skepticism around cryptocurrencies, and the following factors can have a huge impact on cryptocurrency value.

- Supply: This is the complete number of coins and how fast they are being released, lost, or destroyed.

- Market Capitalism: This is the value of all the coins that exist, and how users are perceiving their development.

- Press: This is the way that cryptocurrency is being perceived by the media, and how much attention it is getting.

- Integration: This is how easy it is for cryptocurrency to integrate into existing infrastructure, including ecommerce payment systems.

- Major Events: Significant events like security breaches, economic setbacks, and regulatory updates have an impact on the value of cryptocurrency.

How Does Cryptocurrency Trading Work?

To trade with cryptocurrency, you need a CDF account, where you can speculate on whether the cryptocurrency you have chosen to trade is going to increase or decrease in value. The price that you will see has been quoted in conventional currencies, including the US dollar, and you never actually take ownership of the cryptocurrency yourself.

What is ‘Spread’ in Cryptocurrency Trading?

The spread is the difference between sell and buy prices that are quoted for cryptocurrency. Just like other financial markets, when you open a position on the cryptocurrency market, you will be shown two prices.

If you want to open at a long position, then you will trade with the buy price, which is going to be slightly above the market price. However, if you want to open with a short position, then you will be trading at the sale price, which is going to be slightly below the market rate.

What is a Cryptocurrency Trading Bot?

With the rise of cryptocurrency trades, a completely new industry has opened up, in the form of cryptocurrency trading bots. Cryptocurrency trading bots are automated pieces of software that help simplify the trading process for you.

Because a lot is still unknown about cryptocurrency trading, this means that it can take people months, if not years to work out how to trade successfully, and how to cope with the fluctuating market. For people who are brand new to the industry of cryptocurrency, but don’t have a lot of time to learn on-the-go, a trading bot is a good option.

That means that they are able to automate daily functions like rebalancing their portfolio and checking daily values of the cryptocurrency that they are trading. This not only saves time, but this ensures that they don’t miss out on valuable opportunities to earn more money and sell their cryptocurrency at the right time.

What is a Lot in Cryptocurrency Trading?

Most of the time, cryptocurrencies are traded in lots. These are batches of cryptocurrency tokens that are used to standardize the size of the trade. Because cryptocurrencies are extremely volatile, these lots tend to be quite small. A lot of the time, they are just one unit of the base cryptocurrency. However, sometimes cryptocurrencies are traded in bigger lots.

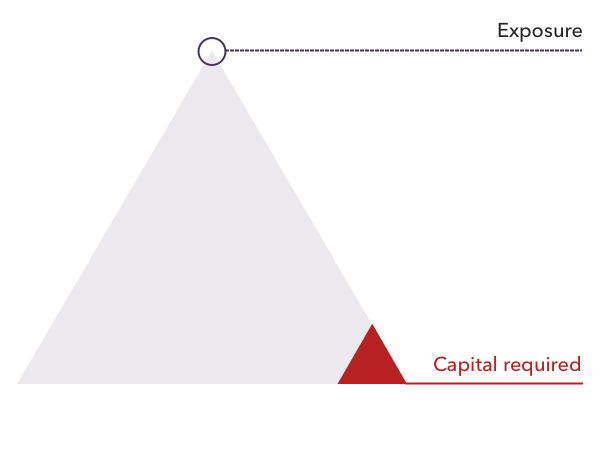

What is Leverage in Cryptocurrency Trading?

Leverage refers to being able to gain exposure to big values of cryptocurrency and avoid having to pay the complete value of your trades in the beginning. Instead, you invest a small deposit, which is commonly known as a margin. When you close your leveraged position, your loss or profit is based on the complete size of the trade.

Leverage is going to magnify your profits, but it also amplifies the risk. If you exceed your margin on an individual trade, then there is the risk that you will lose it all. This is why it’s really important that you learn how to manage your risk when you are executing leveraged trading.

What is Margin in Cryptocurrency?

Margin is an integral part of leveraged trading. As we mentioned briefly above, this is the initial deposit that you put down to maintain your position on the cryptocurrency market.

When you are trading cryptocurrencies on a margin, you need to remember that your margin value is going to differ based on how big your trade size is, and the broker that you’re working with. Generally speaking, it is expressed as a percentage of your full value.

What is a Pip?

A pip is the unit that is used to measure movement in the value of a cryptocurrency and refers to a 1-digit movement and the value at a particular level. Cryptocurrencies are usually traded at the dollar level, so when the value of cryptocurrency moves by $1.00, it has moved a single pip.

It’s really important that you read all of the details on the trading platform that you have chosen to go for, so that you understand how the price movements are going to be measured and learn as much as you can about trading in general before you place your trade.