What is a Blockchain Wallet?

Posts by Colin TanJanuary 21, 2023

On any blockchain platform out there, a wallet can be compared to a bank account, but without the hassle of having to open a bank account. You can go to Bitcoin and create your own personal wallet within just a couple of minutes.

Unlike a bank account, your wallet is forever, and cannot be deleted or closed, whether or not the owner of the wallet is still active and using it or not.

It is Yours Forever – Like an Email Address

To understand what a wallet is in regards to blockchain technology, let us compare it to an email address. Anyone who knows your email address knows that they can contact you through this method.

Of course, they can send emails to this address, but they can’t send emails from it. If someone wants to send an email from your email address, then they need to be able to access your email account, which requires a password, and a lot of the time, another form of authentication.

So, what an email address is to an email communication, a public address is to a blockchain wallet. Every blockchain wallet comes with a private key and this is similar in concept to having a password for your email address and email account.

However, the difference here is that you don’t get to choose your private key, unlike being able to choose a password. A private key is usually a long line of random cryptographic code that is generated by the blockchain for you.

What is interesting is that instead of a long line of cryptographic code, some wallets use seed words as a private key. A seed word is a randomized set of words that are generated during the creation of a wallet.

For example, when you first create a wallet, the wallet might generate 20 random words in a sequence. When you try to access the wallet, it will ask you to enter the words that correspond with a certain number, like the number nine.

Just because you were able to access your email from your smartphone or desktop doesn’t mean that your email is stored in those systems. You are simply using an email server to access your email account. The same can be said for your blockchain wallet.

It doesn’t hold your digital assets; however, they grant you access to your assets on the blockchain through your private key. This means that if you lose the private key to your wallet, then your digital assets will continue to exist in the wallet, but you will have no way of accessing them.

As an example, all Bitcoins can be found on the Bitcoin blockchain. Right now, there are more than 3 million Bitcoins that had been lost forever. Why? Because the owners of Bitcoin wallets lost their private key.

Another scenario is if an investor dies without properly passing on the private key to their heir, then nobody will be able to access the wallet, and that Bitcoin will be lost forever. In any scenario like this, the Bitcoin itself is still on the blockchain, it just won’t be able to be accessed anymore by anyone without the private key.

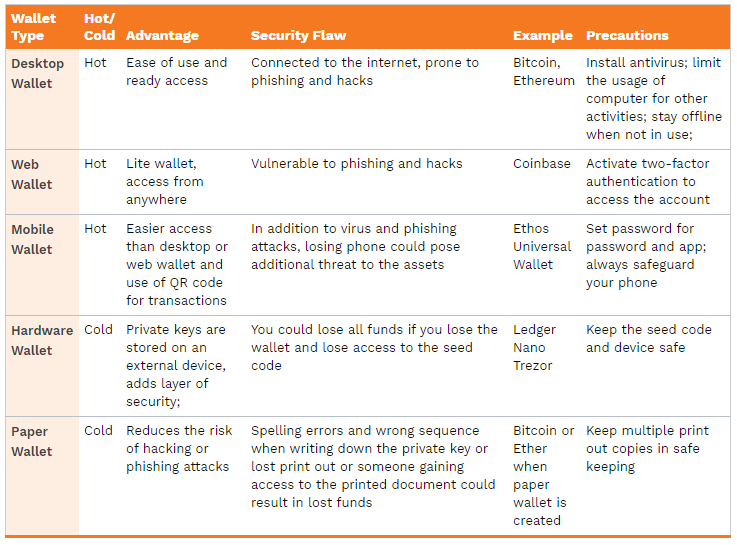

Hot or Cold Wallet?

Blockchain wallets are usually divided into cold wallets or hot wallets. A hot wallet is one that is connected directly to the Internet. For example, Coinbase is a wallet app that allows you access to digital assets through your account, when you log into the website, or download the app.

When you access your digital assets, you are just looking at the information of these assets, and they aren’t actually being held in the account. However, if that account is hacked, your digital assets could be stolen, and lost forever.

In contrast, a cold wallet stays offline. The private key to your wallet stays offline, so that hackers can’t access your funds when trying to infiltrate your private key.

Different Kinds of Wallets

- Desktop Wallet: With any public wallets, you can download them onto your computer. If you own a number of different cryptocurrencies, then you might need to ultimately install separate wallets for each cryptocurrency. For example, you can go to Bitcoin.com, and download a Bitcoin wallet onto your computer where you can store your Bitcoin cryptocurrency. It’s really important in this instance that you scan your desktop for malware and viruses and install antivirus software so that you can avoid someone hacking into your computer and stealing your digital assets.

- Mobile Wallet: A mobile wallet is similar to a desktop wallet, except that you will need to install it on your smartphone. The best part of using this kind of wallet is how easy it is. You will also need to keep your passcode secure and your phone safe so that you can protect your private key. There are people out there that have lost their digital assets by falling victim to phone scams.

- Exchange Wallet: Whenever you create an account with digital asset exchanges, you will be immediately given an online wallet address for each of these assets. However, you will not be given the private key. If Coinbase for example was hacked into and all of its digital assets were stolen, then there is no protection for your digital assets, because you do not control the private key.

- Cloud Wallet: There are a lot of people out there that don’t see the difference between a cloud wallet and a wallet on an exchange. In theory, they are right. However, when it comes to user experience, there is a difference. With an exchange wallet, you do not own your private key. However, with a cloud wallet, you do own your private key. This means that you can send and receive your cryptocurrency through a cloud wallet.

- Hardware Wallet: A hardware wallet is considered one of the most sought-after wallets to protect your digital assets. This means that instead of relying on the cloud or your desktop to store your wallet, a hardware wallet will keep the private key completely offline. You will be able to perform digital transactions by connecting your device to your desktop. Just make sure that you don’t buy a hardware wallet that has already been used.

- Paper Wallet: A paper wallet is the kind that you create and print out on paper. This kind of wallet is most popular with cryptocurrency veterans, and they create the wallet offline, print it out on paper using a printer, and therefore leave no trace of their wallet other than the paper copy. This creates a cold storage, and it offers the highest level of security against online threats and hackers. However, as you might have been able to guess already, this kind of wallet doesn’t provide frequent opportunities for digital transactions. Therefore, there are advantages and disadvantages to this kind of wallet.

- Multi-Asset Wallet: This is less of a wallet and more of a feature. A multi-asset wallet can support more than one digital asset at the same time.

How to Keep Your Wallet Safe

Digital assets worth hundreds of millions and sometimes billions have been stolen from investors. Therefore, we highly recommend that you take the following precautions to make sure that you can keep your digital assets safe.

- Don’t Share Information: This might seem obvious, but you wouldn’t share your ATM pin or your email password with just anybody. This is why we highly recommend that you keep your private keys safe, and never share them with anyone, no matter how convincing they sound. There are a lot of con artists out there that might try to send you a genuine-looking email or text message, or even call you to try and gain access to your private key.

- Keep the Integrity of Your Connecting Device: Whether you’re using a desktop wallet or a hardware wallet, you need to make sure that you are scanning your device regularly for malware. Never click on any links that you aren’t sure of, and always make sure that you are typing a website address into a secure browser whenever you are trying to access your wallet.

- Use Two-Factor Authentication: We always recommend that you implement two-factor authentication wherever you can. This adds a second level of protection in addition to that initial password.

Not only is a digital wallet an important part of your cryptocurrency trades online, but so is a trading bot. In fact, if you are just getting into the cryptocurrency trading game, you don’t really want to go too far without these two assets.

Once you have figured out what kind of wallet you want to invest in for your cryptocurrency trades, you then need to think about what trading bots you want to look at as well.

A trading bot can help you streamline the process of getting started with your cryptocurrency trading, which is especially important if you are brand new to the industry. It can help you rebalance your portfolio and work out when to sell and when to buy your cryptocurrency.

This kind of automation is essential if you’ve still got a lot of learning to go, and don’t have too much time during the day to devote to learning about cryptocurrency trading. Good luck!