What is Cryptocurrency Mining? How Does it Work?

Posts by Colin TanMarch 12, 2024

Crypto mining has only been around since Bitcoin first came to the fore in 2009, but since then it has made quite an impression with cybercriminals, investors, and minors. Here is everything you need to know about cryptocurrency mining, and how it works.

Cryptocurrency mining, otherwise known as crypto mining, is a popular topic on Internet forums. You have probably seen a lot of videos out there and read through articles about Bitcoin, and other kinds of crypto currencies. And in these articles and videos, the topic of cryptocurrency mining comes up a lot of the time. As a result, you might be wondering what this is.

Cryptocurrency mining is a term that relates to collecting cryptocurrency as a reward for work that you have done. It is known as Bitcoin mining when someone works with Bitcoin specifically. However, why do people crypto mine? For a lot of people out there, they are trying to find another source of income.

For some, it’s about finding financial freedom online, without the government or the banks being able to gain access to their funds. Whatever the reason for it to, cryptocurrencies are growing exponentially in popularity, and there are many people benefiting from them.

What is Cryptocurrency Mining?

The phrase ‘cryptocurrency mining’ means collecting cryptocurrencies by finding the solution to equations related to cryptography through a computer. This process involves adding transaction records to a public ledger, which is often known as a blockchain. It also involves validating data blocks within this blockchain as well.

Cryptocurrency mining is a transactional method that uses computers and cryptographic processes to record data and solve complex equations related to a blockchain. There are big groups of devices that are primarily involved in crypto mining, and they keep a shared record of what they are doing through these blockchains.

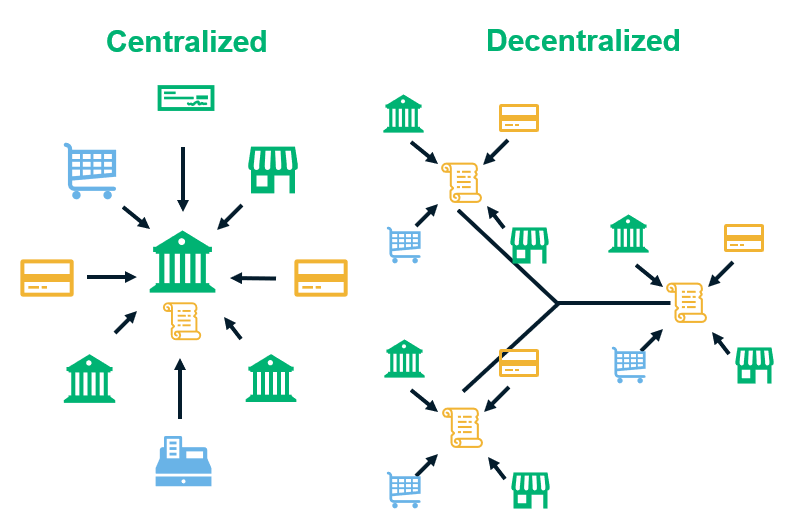

It is vital that you understand that the cryptocurrency market is an alternative to the conventional banking system that we currently use around the world. So, to be able to figure out how cryptocurrency mining works, you will need to understand the difference between decentralized and centralized systems.

Conventional Banks are Centralized Systems

With conventional banking, you’ve got one authority that maintains, controls, and updates a ledger. This means that every single transaction needs to go through this ledger, where it is verified and recorded. Of course, this means that the system is restricted, and only a small number of banks are allowed to access the centralized system.

Cryptocurrencies are Part of a Decentralized System

When it comes to cryptocurrencies, there is no one authority, and there is not one big ledger that everybody uses. This is because cryptocurrencies use a decentralized system with a ledger that is distributed among its users, which is more commonly known as a blockchain.

Unlike conventional banking systems, anybody can connect to the cryptocurrency system. You can send and receive payments without having to go through your traditional bank. This is why it is known as decentralized digital currency.

As well as being decentralized, cryptocurrency is also considered a distributed system. This means that the ledger of all transactions is widely available to the public and stored on many different devices. This is different from traditional banks, which have centralized systems that only a few people have access to.

However, without a central bank, how are transactions verified before they are added to the ledger? Instead of using a central banking system to verify these transactions, cryptocurrency uses a cryptographic algorithm to verify the transactions.

So, this is where Bitcoin miners come in. The thing about completing these cryptographic calculations is that they result in a lot of computer work. Miners use their computers to complete this work, and as a result, they get a small amount of cryptocurrency for the trouble.

Understanding Distributed, Decentralized, and Centralized

To help you better understand what we’re talking about, let’s take a look at the following demographic.

As you can see in the graphic above, we have outlined the differences between a decentralized system, and a centralized one. On the left-hand side of the graphic, you’ll see an illustration of a centralized system.

This conventional centralized system operates through using technologies, computers, and networks that are operated, managed, and owned by financial institutions. This means that whenever you send money to a friend or family member, this transaction goes through the bank.

However, a decentralized system uses a network of managed, operated and owned devices that are independent. They contribute their resources to create a decentralized network, and they share the responsibility of updating and managing the ledger and verifying transactions as result. This means that there is no singular centralized authority that manages the ledger.

So, when we discuss distribution, what do we mean by this? Distribution means that there’s a synchronized ledger that is shared across multiple locations by various participants, who are considered the verifiers and observers of the transactions.

Is Crypto Mining Legal?

Generally speaking, crypto mining is legal. However, there are two things to consider when you determine whether crypto mining is legal or illegal. The first is your geographic location, and the second is whether you are mining cryptocurrency through legal means.

Crypto mining becomes illegal when you use illicit means to mine your crypto currencies. As an example, there are some cybercriminals out there that use JavaScript to install malware on someone’s devices, so that they can access and hack into their processing power. Of course, this kind of mining is illegal.

What makes it somewhat complicated though is that cryptocurrency mining is seen differently by a number of governments around the world. In Germany, for example, mining cryptocurrencies like Bitcoin is seen as fulfilling a service that is a centralized part of the Bitcoin cryptocurrency system.

There are also a lot of local governments in China that are cracking down on Bitcoin mining, which is causing a lot of companies out there to stop mining Bitcoin completely. Also, some countries see cryptocurrency mining profits as being taxable, while other countries consider it nontaxable income.

Now, let’s break down how cryptocurrency mining works. We will take a look at the technologies and processes that are required to mine cryptocurrency.

How Cryptomining Works

To keep it simple, people who mine cryptocurrency verify the legitimacy of transactions so that they can reap the rewards of their work in the form of more crypto currency. To understand how most cryptocurrency mining works on a more technical level, you will need to first understand the processes and technologies behind it. This involves needing to understand what blockchain is, and how it operates.

There are two things that are essential to the idea of blockchain: math, and public key encryption. For a lot of people out there, math isn’t their strong suit, however, it is an essential part of blockchain, and it is important that you have a good grip on it if you want to do well in this field.

Conventional crypto currencies like Bitcoin use a decentralized ledger that is called blockchain. Blockchain is a series of chains of data blocks that hold the keys for bits of data, including hashes that are cryptographic. These blocks are integral to the blockchain, and they are groups of data transactions that will be added to the end of the ledger.

Of course, this adds a layer of transparency to the ledger, but it also adds an ego boost when people see that they have added transactions to the blockchain. It doesn’t actually include their name, but they recognize the transaction as theirs, and it does a lot for their ego.

Breaking Down Blockchain

There are a number of integral processes and components that are involved in creating a blockchain. For this example, we are going to refer to Bitcoin.

- Nodes: Nodes are the devices and individuals that exist within the blockchain, so for example this is your desktop, and the desktop of other cryptocurrency miners.

- Miners: These are the particular nodes whose job is to solve blocks that haven’t yet been confirmed in the blockchain, by legitimizing the hashes. Once a node or miner is able to verify a block, the confirmed block can be added to the blockchain. The first miner to do this shares it with the other miners that they’ve solved the problem and is given cryptocurrency as a reward.

- Transactions: The transaction is the thing that starts the entire process in the first place. The transaction is the exchange of cryptocurrencies between two parties. A singular transaction gets put into a group with others to form a list that will get added to an unconfirmed block. Then, each data block needs to be verified by a miner.

- Hashes: Hashes are one-way cryptographic functions, which makes it possible for miners and nodes to verify the legitimacy of a cryptocurrency transaction. It is an essential component of every block in the blockchain. It is generated by combining the header data from the last blockchain block, with a nonce.

- Nonce: Nonce is a technical term to describe a number that is only used once. It is considered a random or non-repeating value. This will get added to the hash and each block of the blockchain, and it is the number that the miners are trying to solve for.

- Consensus algorithm: A consensus algorithm is a protocol within the blockchain, which helps different notes come to an agreement, so that they can verify data. The first kind of consensus algorithm is considered proof of work.

- Blocks: The blocks are the individual parts that compromise each blockchain overall. Each block includes a list of transactions that have been completed. Once a block has been confirmed, it cannot be modified in any way. If you wanted to make changes to an old block, this would mean that the block’s hash would have to be recognized by all of the other nodes, and a peer-to-peer network. This means that it is virtually impossible to modify a block once it’s been verified and added to the blockchain.

- Blockchain: The blockchain is the series of blocks that are listed in chronological order, based on when they were added to the chain. Because you cannot alter or modify a previously published block, this provides a level of transparency. At the end of the day, everybody has access to these transactions, so this level of transparency is really important.

The Crypto Mining Process

Now that we have broken down blockchain for you, let’s take a look at the cryptocurrency mining process, so that you can understand how it works better.

Nodes that Verify Transactions are Legit

Transactions are the foundation that a cryptocurrency blockchain is built on. So, let’s take the following example, so you can understand how this all comes together. Let’s say for example that you are a cryptocurrency miner, and your friend Adam borrows $4000 from your other friend Jack to buy a brand-new gaming setup.

It’s a state-of-the-art computer that comes with all the latest gaming paraphernalia. To pay Jack back, Adam sends him a partial Bitcoin unit. However, for the transaction to go through, it needs to complete the verification process.

Separate Transactions Come Together to Form a Block

The next part in the cryptocurrency mining process is grouping all transactions together into a list, that is then added to an unconfirmed block of data in the blockchain. So, this means that Adam’s Bitcoin payment to Jack can be considered one of these transactions.

By adding the transaction to the blockchain, this prevents spending any cryptocurrency more than once, and keeps a public, permanent record of the transaction. Remember, this transaction cannot be altered or adjusted in any way.

A Hash Can be Included with the Unconfirmed Block

Once there are enough transactions that have been added to the block, other information is added as well, including the hash, and header data from the last block in the chain, as well as a new hash for the new block. A nonce and the header of the most recent block are combined to generate a brand-new hash. This hash gets included with the unconfirmed block and now needs to be verified by a node or miner.

Let’s say that in this case you are the lucky person that was able to solve the block. As a result, you let the other miners in your network know so that they can verify that you’ve really solved it.

Miners Verify the Blocks Hash

In order to verify that the block’s hash is legitimate, other miners will have to verify it. However, the thing about a hash is that it is notoriously complicated. This means that not just anyone can do this – you’ve got to know what you’re doing and be somewhat of an expert.

The Verified Block Now Gets Published in the Blockchain

When the proof of work is complete, and the time-consuming process of solving the hash is complete, it is time to celebrate, and the block can now be added to the blockchain.

What this means is that Adam’s transfer of a partial Bitcoin transaction to Jack has now been confirmed and can be added to the blockchain. Because it is the newest block to be added to the blockchain, it will be included at the end.

How This all Works Together

So, you might be wondering at this point how the ledger stays secure from unauthorized modifications and manipulation. All transactions that get added to the ledger are encrypted using public key cryptography. This means that for the block to be accepted, it must use a hash that is unaltered and genuine.

Who is in Charge of Updating Blockchain?

Going back to decentralized versus centralized systems, because there is no centralized authority to regulate and manage Bitcoin exchanges, this means that the computers that mine the cryptocurrency are responsible for keeping the ledger updated. And, as you may have been able to guess already, updates to the blockchain are pretty frequent.

Because the ledger is public, anybody can see a cryptocurrency blockchain, and you can even use your computer to generate random guesses to try and solve an equation that the blockchain system presents. If you are successful with this, then your transaction will be added to the newest data block, to be verified by miners.

If you are not, then you will need to try again, until you are successful. At the end of the day, you might decide to put your time and effort into something else.

Now that you know what cryptocurrency mining is and how it works, let’s take a look at some of the different types of cryptocurrencies out there, and why someone would want to mind them.

The Different Types of Cryptocurrencies

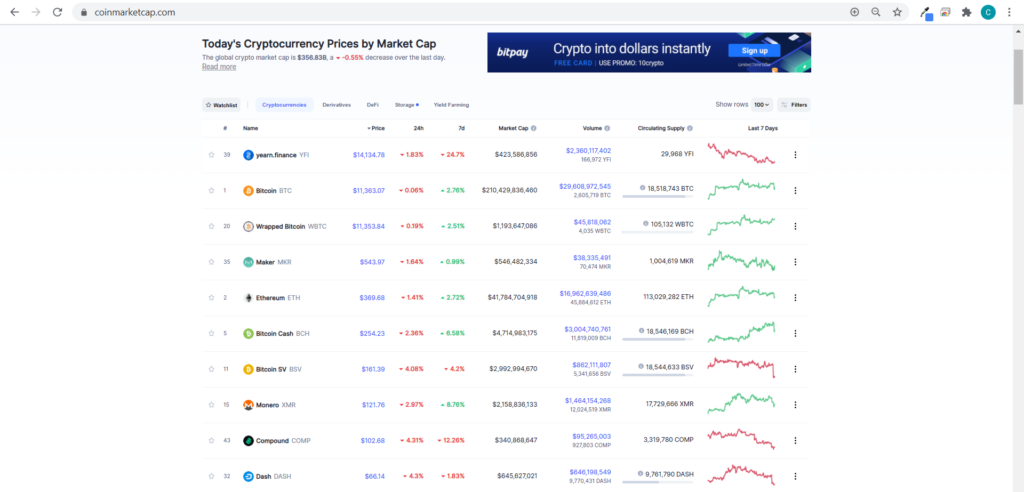

Of course, at this point you have heard of Bitcoin, but there are other types of cryptocurrencies out there, including Monero and Dash.

However, what you might not be aware of is that there are actually thousands of different kinds of cryptocurrencies in the virtual world right now. It is estimated that there are more than 7000 cryptocurrencies floating around, and that the global cryptocurrency market is worth more than $300 billion.

Just like the traditional stock market, cryptocurrency values fluctuate every day, and vary greatly.

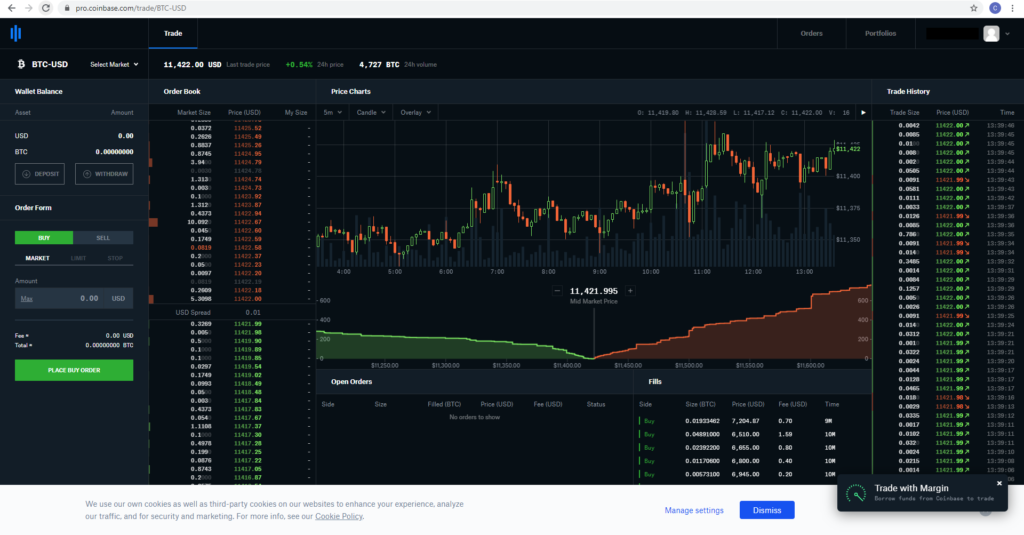

Why You Should Make the Most of a Trading Bot

Because there are so many cryptocurrencies out there these days, this is an unprecedented opportunity for you to take matters into your own hands when it comes to cryptocurrency trading.

Cryptocurrency trading is becoming just as popular as traditional stock market trading, and the best part is that you can learn the process of cryptocurrency trading yourself and do it from your smartphone. However, if you are brand new to this industry, you are probably feeling a little bit green, and you’re not too sure which cryptocurrency to go for first, or even how to trade.

This is where cryptocurrency trading bots come in. Crypto trading bots are automated pieces of software that streamline the process of your trades, so that you can keep everything in one dashboard, and make your trades with ease.

A lot of the time, they can even complete your trades for you, and they will keep a regular eye on the market, determining where your cryptocurrency is best spent. In a world of virtual transactions, you’ve got every chance of doing really well and making a lot of money, and if you add a trading bot to your list, you only increase these chances.

Why is Cryptocurrency Mining Such a Big Deal?

Being able to make transactions virtually and use money digitally is becoming more and more popular. Debit cards, credit cards, and online transaction services like PayPal make it super easy to buy items online and send money to family and friends. In a world with next-day delivery services, and E-commerce sites, there are a lot of people out there that don’t want to deal with the hassle of coin currency, and paper cash.

However, what encourages someone to start a career in cryptocurrency mining? Let’s take a look at some of the reasons while you might want to consider this new career path.

People Want More Privacy and Control of Their Finances

Not everybody out there is quick to trust the existing centralized banking systems. There are a lot of people out there that would prefer to have more control and privacy when it comes to their personal finances. The idea here is that the biggest banks in the world don’t need to know when you purchase underwear online, or how much you spent on that brand new guitar.

So, to avoid being part of the conventional centralized banking system, a lot of people are keeping money under their mattresses, or in a tin can in their pantry. However, there’s another way that people can keep their money out of the centralized banking system, by using cryptocurrencies, and mining for cryptocurrencies.

Cryptocurrencies like Bitcoin offer a good level of anonymity to its users. Why? Because the crypto mining process includes public key encryption.

Cryptocurrency can be Incredibly Profitable

Of course, the cryptocurrency market can be just as volatile as the traditional stock market, but that doesn’t mean that you don’t have a chance of making a lot of money with virtual currency. As you can see from the screenshot that we have taken above, Bitcoin is changing in value all the time.

This is why for some, cryptocurrency mining is seen as an incredibly profitable venture, and is considered a good investment. However, for a lot of people as well, this isn’t the case a lot of the time, because there is the risk of not getting a high return on your investment too.

Cryptocurrency is Still New and Shiny

There are also a lot of people out there that want to jump on the bandwagon of the newest technology before the novelty wears off. They want to be a part of the next best thing, and so they will try anything, as long as it’s new.

Why Doesn’t Everyone Do it?

Despite the fact that cryptocurrency might seem appealing at this point, it’s definitely not for everyone. Let’s take a look at why it’s not for everyone, despite the fact that it is so simple.

- It is Resource-Intensive: Cryptocurrency mining requires a lot of resources when it comes to not only computing power, but electricity. This is because cryptocurrency mining requires a lot of computer power to generate new guesses all the time. If you are successful in your venture, then not only do you generate new Bitcoin, but you also get to add information to the end of the ledger in the form of the blockchain.

- It Can Be Expensive: Not only do you have to worry about how much electricity and processing power you are using up, but you’ve also got to keep in mind that a venture like this can be pretty expensive. Back in the day, it was possible to crypto mine just from your personal desktop, but these days, is no longer possible. If you want to give yourself even a small chance of beating other cryptocurrency miners out there, then you will need to invest in the processing capacity to compete at that level. This means having more devices and spending a lot more money on your equipment.

- The ROI isn’t What it Used to be: Yes, there are people out there that have been able to make a lot of money by mining cryptocurrencies, but this doesn’t mean that everyone can. As more time goes on, and more people get involved, the competition gets hotter, and there is a decreasing return on investment as the landscape becomes oversaturated. Bitcoin is a really good example of this. Approximately every four years, Bitcoin goes through an event that is known as halving. This means that the number of Bitcoins that people receive as a reward for every block that they solve is going to be reduced by half.

| Year | BTC Received Per Block | Event |

| 2009 | 50 BTC | (Original BTC Mining Rate) |

| 2013 | 25 BTC | First Halving Event |

| 2016 | 12.5 BTC | Second Halving Event |

| 2020 | 6.25 | Third Halving Event |

- It Might Not be Legal Where You Are: remember when we talked about how different governments around the world see cryptocurrency mining differently? This means that based on where you are in the world, you might not even have access to cryptocurrency mining, because it might be illegal. Some governments will prohibit using cryptocurrencies as a payment method.

Final Thoughts

Cryptocurrency mining is definitely an interesting alternative to conventional centralized banking systems. however, when it comes to power resources and computer time, it can be very taxing, and as a result, it isn’t feasible for many.

If you are trying to make money from cryptocurrencies, then consider recruiting the help of a trading bot that can complete some of the processes for you, so that it’s not as time-consuming.